36+ mortgage debt to income ratio limit

Husband is 8 years away from retirement. Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money.

How To Get A Mortgage Home Loan Tips

Web Here are debt-to-income requirements by loan type.

. Compare Mortgage Options Get Quotes. Ad Calculate Your Payment with 0 Down. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

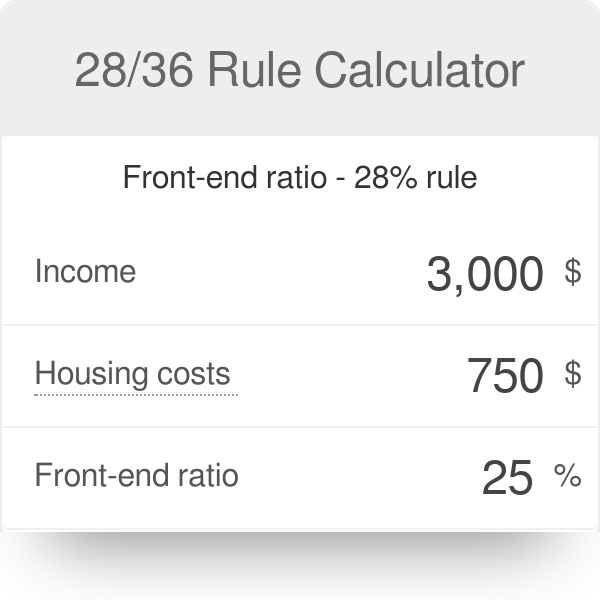

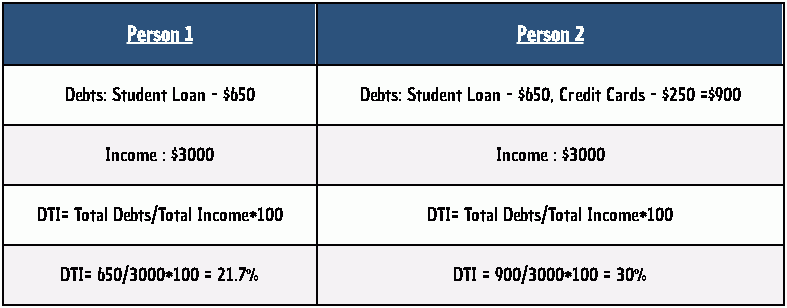

The rule says that no more than 28 of your gross monthly income. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

Web For example say your total monthly debt payments for a mortgage plus a car loan equals 1500 and your gross monthly income is 5000. Web 1 day agoIn January 2023 FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income DTI. Apply Now With Quicken Loans.

Web As one of the most used variables to get approved for a loan debt-to-income ratio is calculated based on your monthly debt payments and divided by your gross. Get Started Now With Quicken Loans. Heres how lenders typically view DTI.

That means your mortgage debt-to. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Ad See how much house you can afford.

Web Your maximum for all debt payments at 36 percent should come to no more than 2160 per month 6000 x 036 2160. Get Started Now With Quicken Loans. If your home is highly energy-efficient.

Ad Compare Mortgage Options Calculate Payments. Web Calculating your debt-to-income ratio DTI measures your debts as a percentage of your income. Ad Compare Mortgage Options Calculate Payments.

Compare Mortgage Options Get Quotes. Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses. Ideally lenders prefer a debt-to-income ratio.

In reality however depending on your. Apply Now With Quicken Loans. His main IRA is 86 percent stocks.

Web Most traditional lenders require a maximum household expense-to-income ratio of 28 and a maximum total debt to income ratio of 36 for loan approval. Web If the lender requires a debt-to-income ratio of 2836 then to qualify a borrower for a mortgage the lender would go through the following process to determine what expense. Web Question about 1 years salary by 30 3 by 40 rule.

Youll usually need a back-end DTI ratio of 43 or less. Estimate your monthly mortgage payment.

:max_bytes(150000):strip_icc()/avoiding-bad-home-layout-1798346_final-92e4aab4fe7d4913ac1493d24fc8267f.png)

What Is The 28 36 Rule Of Thumb For Mortgages

What S A Good Debt To Income Ratio For A Mortgage

28 36 Rule Calculator

How Much House Can You Afford The 28 36 Rule Will Help You Decide

What Is The Debt To Income Ratio For A Mortgage Freeandclear

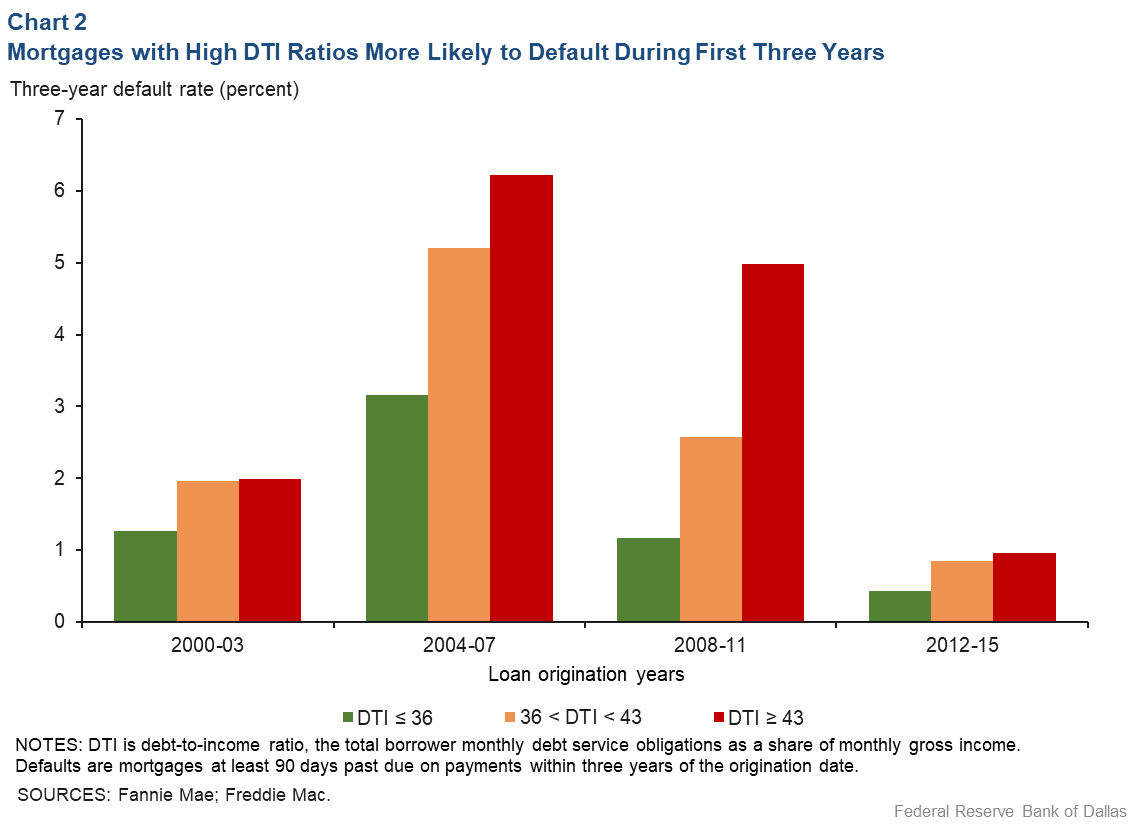

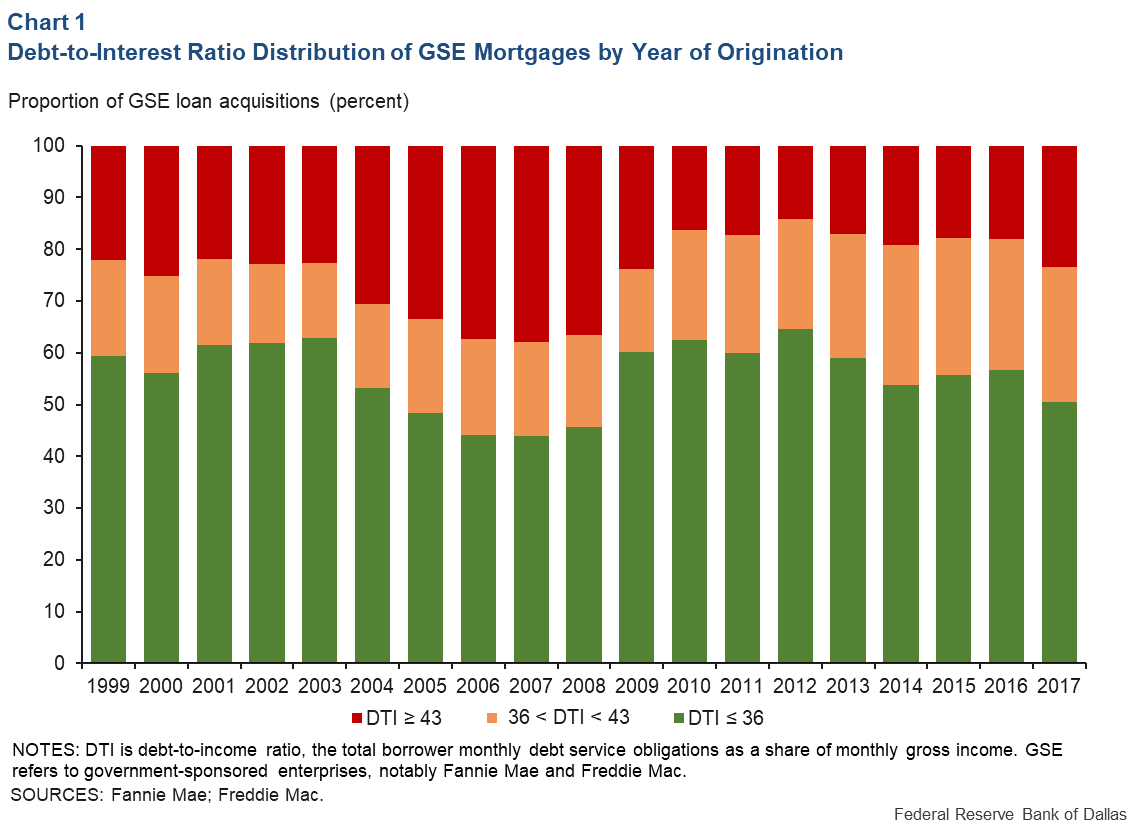

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Why Mortgage Applications Get Rejected What To Do Next

How Much House Can You Afford The 28 36 Rule Will Help You Decide

How Much House Can You Afford The 28 36 Rule Will Help You Decide

What S A Good Debt To Income Ratio For A Mortgage

What Is Debt To Income Ratio And Why Does It Matter Consumerfinance Gov Youtube

How Your Debt To Income Ratio Can Affect Your Mortgage

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Debt To Income Ratio Dti What It Is And How To Calculate It

What Is Debt To Income Ratio Importance In Mortgages Cc

Socio Economic Impacts Of The Covid 19 Pandemic On New Mothers And Associations With Psychosocial Wellbeing Findings From The Uk Covid 19 New Mum Online Observational Study May 2020 June 2021 Plos Global Public Health